In getting to grips with “neoliberalism”, a recommended first port of call is the published transcripts of Michel Foucault’s 1979 lecture series at the Collège de France titled The Birth of Biopolitics.[i] In those lectures Foucault demonstrated that the foundations of neoliberalism emerge from a critique of the classical liberal accounts of laissez-faire capitalism. Where classical liberalism saw the economy as a natural order between people that the state would do well to keep entirely clear of, neoliberal thinkers saw the state as the regulatory guarantor of a market which is entirely constructed. Where classical liberalism articulated market activity in terms of exchange, neoliberalism supersedes it with the concept of competition. Neoliberalism thus demands a role for the state: to ‘intervene on society so that competitive mechanisms can play a regulatory role at every moment.’[ii] It follows that the place of the individual in this project is not as the classical liberal subject of natural exchange, but as a competitor in a market. This being the case, the neoliberal project calls for the individual to see the various parts of their life (health, education, employment) as investments in themselves for which they are entirely responsible and, through their investment, will make them better market competitors.

What is truly remarkable about these lectures is that Foucault appears to capture the essence of this school of thought just as its major ideas were beginning to make their way into governmental policy through the full throttle political projects of Thatcher and Reagan, a moment described by Pierre Dardot & Christian Laval recently as “the great turn.”[iii] As Dardot & Laval and, more critically, Phillip Mirowski[iv] would probably agree: Foucault’s insights articulate a logic of neoliberalism that remains very much the paradigm of the present day. Indeed, the remarkable pace at which these ideas have become hegemonic is demonstrable through not only their adoption by the “new left”, which includes the New Labour project here in the UK, but also in current approaches to international development, post-conflict reconstruction and peacebuilding, which embrace the idea of competitive markets as well as concepts like “human capital”.

Nevertheless, I want to focus on the recent work of Michel Feher, which sheds a slightly different light on the neoliberal world we find ourselves in. Indeed, Feher’s recent lecture series given at Goldsmiths College,[v] presents a very different analysis. In these lectures, Feher outlines what he believes is an “anthropological” shift, one which he terms the neoliberal condition. His analysis is concerned with the emergence of “a new moral anthropology,” that is, a new “representation of the human condition,” precipitated by a turn towards neoliberal (or neoclassical) economics.[vi] Feher’s point here is that different forms of governance are co-emergent with their own representation of the human condition. Neoliberalism thus represents a radically new form of governance, which is co-emergent with its own representation of humanity. Moreover, the latter acts as the interlocutor for the former, such that the act of government is about cultivating the good propensities of its own particular vision of mankind.

Whilst ardent Foucauldians might recognise this analysis so far, it is important to point out that Feher’s analysis differs from Foucault’s. Indeed, Feher is not that concerned with the theoretical move from exchange to competition, which is central to Foucault’s analysis. Instead, by turning Hayek’s contention that “societies are the product of human action but not human intention” against neoliberalism itself, Feher’s emphasis is firmly placed on a kind of inadvertent anthropological shift caused by processes of financialisation that began with the rise of financial markets in the 1970s. For Feher, financialisation defines a new governmental mode with its own set of practices. The most fundamental is a new logic of corporate culture, which moves away from maximising profit to permanently raising the value of the stock. Such a transformation provides a model through which we can understand the transformation not only of institutions (companies and governments) but also of the subject.

Feher thus argues that neoliberalism is, first of all, an economic shift; from an economy of exchange and profit to a financialised economy of speculation and credit. Importantly, this is accompanied by the emergence of the “invested self,” with its own psychological shift: from a psychology of desire and satisfaction (profit) to a psychology of vulnerability and self-esteem (credit). Where Foucault shows that neoliberalism conceives of individuals as enterprises competing for their own profits, Feher demonstrates that financialisation produces a subject who is, in fact, a manager of their own portfolio seeking investment. In other words, the subject is the invested self whose activities construct her as a project which is worthy of investment. Psychologically, then, the invested self is made vulnerable by opening up their own investments to the judgments of investors, with the payoff of self-esteem generated by investments that come from employers, sources of financial credit, and so on.

My interest in Feher’s work is not so much the impressive novelty of this aspect of his analysis, though that is certainly true. Instead, it is the way in which his analysis leads to a set of prescient (and pressing) points for those interested in articulating an alternative to the current situation. First and foremost, Feher’s point is that resistance cannot be conceived as a total rejection of the neoliberal condition. Indeed, the emergence of neoliberalism also necessitates the transformation of forms of resistance such that they are up to the task of confronting this new constellation. In this regard, Feher’s point is that resistance must be entirely rethought on an uncomfortable premise: embracing the neoliberal condition, at least to a certain degree, in order to resist its exploitation. Feher’s point is that we should get to grips with the new terms of our exploitation in order to formulate new resistances, as “investee activists”.

To understand what Feher means, it is important to understand his delineation of the workers’ movement as a historically situated reaction to the classical liberal model of exchange. As Feher sees it, this movement is predicated on embracing this model. In particular, Feher argues, the workers’ movement grew out of the classical liberal model of the “free worker” where labour was constituted as a commodity and “priced as such.” Pointing to Marx, Feher shows that the workers’ struggle analysed the problem of classical liberalism as the exploitation of free workers, who sell their labour in the market for less than the value their labour produces – surplus value. In other words, the exploitation takes place when the labour power is exchanged for a wage, which is less than the value they produce for the employer. As such, the employer and their extraction of profit from the labour of the worker is the source of exploitation.

Against this problem, the workers’ movement understood that struggles against this form of exploitation must be oriented around disrupting the model of exchange. As Feher outlines, the workers’ movement saw that they could be united as a class by the common fact of their being salaried – and thus exploited – workers. But their formulation as a class, and their entrance in the labour market as a collective in the form of unions, was premised on their understanding that collective bargaining (through strikes, for example) could be a useful tactic in order to negotiate the improvement of their wages and their conditions. For Feher, it is precisely this collective appropriation of exchange and negotiation that made the worker movement so potent and paved the way for the achievement, in the UK at least, of the post-war welfare settlement.

Today, Feher argues, investors – and not employers – are at the forefront of the new neoliberal reality and its exploitation. They are the beneficiaries not of labour markets but of financial markets where projects become assets and are evaluated by the investment of capital by shareholders. Investors do not fit the profile of the classical business owner. Undoubtedly, they continue to extract profit in the form of dividends in the market or interest in the bond market, for example. But their main function is not the appropriation of the labourer’s surplus value; rather, it is the power to “select the endeavours that deserve to receive resources.” Investors speculate and bring projects to fruition, by allocating credit to those they deem worthwhile. Investors aren’t involved in the appropriation of income from workers but the accreditation of certain projects. The “harm”, therefore, is not the extraction of surplus value – although no one doubts that still continues – but the undemocratic allocation of resources and the violent consequences that follow the free flows of speculation.

In this sense, resistance to neoliberalism cannot be formulated through the relation between the employer and the worker. Instead, the investor addresses prospective investees, who they understand as “projects” or potential “assets”. The investee is a broad term, which includes not only governments (assessed through provisional budgets), but corporations (evaluated by their business plans), loan seekers (through their credit rating), and so on. It is precisely this relation between investors and investees that Feher says must be understood as the prime relation of neoliberal capitalism. What are the consequences of this transformation for our resistance? This is certainly a complicated proposition, and one that challenges the very core of the old left oriented around the struggle of workers. What is the horizon for a new politics based on investees, according to Feher at least?

In classical Liberalism, the concept of exchange as the prime relation between employers and employees necessitated the mastery, by the working class, of the model of exchange in order to change the conditions of labour and production. In a similar way, Feher argues, an investee movement must appropriate the condition of credit seeking project, in order to enter the capital market and change the conditions under which credit is allocated. Feher’s point is that while the investor is in charge of the means of accreditation, they control the measures of credit worthiness. Credit-worthiness is usually a heady mix of low labour costs for corporations as projects, diminished public spending and business friendly taxation for governments as projects, and, finally, infinite flexibility for individuals as projects. Any resistance, therefore, should aim to enter into financial markets to alter the terms under which these projects are attractive: “to make the promise of sustainability more important than the promise of short term profitability, to make access to knowledge and care more important than the reinforcement of intellectual property rights and so forth.” What does this mean in more concrete terms?

First of all, this means that we must come to terms with a tactical shift; the neoliberal condition necessitates a transformation of the tactics of resistance. Remembering that neoliberalism is no longer premised on the market of exchange but of stocks and shares, Feher argues that any new movement must be proficient in the workings of speculation. Simply put, in order to resist we must learn how to make bets, and to force investors to make bets on our bets. It is thus a question of whether it is possible to make alternative speculations that can constrain or overthrow the speculations of investors; can investees create new practices of speculation that are able to democratically appropriate the means of investing? At present, the realities of this point remain uncertain, and they very much rest on practice, experimentation and refinement. Nevertheless, Feher does point us towards some co-ordinates with which it might be possible to begin our experiments. Without the time to go into detail I point the reader to the beginning of lecture 7, which provides a detailed analysis of Syriza’s Yannis Varoufakis as one of the first left wing politicians to mobilise an alternative art of speculation.[vii]

But resistance is also a matter of understanding that the neoliberal condition forces us to rethink the subject of resistance. If the workers’ movement was the coming together of employees as a class, then the new movement must be predicated on a new class formulated out of the relationship between investors and investees. Locating the terms and interest of a new collectivity is no mean feat, but it is one, Feher argues, that can be accomplished by turning, perversely, to business management manuals. There, Feher points out, the creation of value by the firm is theorized as the product to two different actors. On the one hand, value is created by shareholders or potential shareholders. On the other hand, value is created by stakeholders or those implicated in the functioning of the firm without owning any part of it, that is employees, governments, taxpayers, even the environment (as natural resources at least). For Feher, it is precisely this second category, which presents opportunities for a new collective consciousness.

In this sense, the dynamics of a new struggle is not envisaged by Feher as taking place between investors and projects (individuals, corporations and governments), but rather between the shareholders and the stakeholders of projects. Indeed, there is a rather bigger scope here; not only does this relation pertain to corporate projects (companies), but following the advent of New Public Management it pertains to governments as well. Because governments are now understood as businesses, that is, projects, and because they are also subject to financialisation in the form of bonds, they are also subject to this dichotomy. The division is thus bondholders, on the one hand, and stakeholders (citizens, migrants, the environment, and so on) on the other.

This being the case, the possibility of resistance hinges on the question of whether stakeholders can be united as a class in order to make alternative speculations. No doubt, there are inherent difficulties in uniting disparate stakeholders to a common cause. However, many expressed similar sentiments about uniting workers in disparate realms. Indeed, it might be possible to grasp some opportunities, if we attempt to think about the figure of the stakeholder as the unified interests of an “ecology,” and all the connotations that term evokes. The continuing exploitation of the earth’s natural resources, for example, is obviously not just a problem for the environment as a natural entity which is hermetically sealed from a “human realm” articulated purely through roles like the worker, the citizen or the consumer. It is also the set of systems that support our lives, and as such part of a whole with which we are co-emergent and within which we are inextricably interwoven. The existential threat to these systems is perhaps the starting point at which a new collective interest can rally around in order to imagine new alternatives.

Such possibilities are a speculation of my own, of course, but they demonstrate the value of Feher’s work. Indeed, whatever the possibilities might be, Feher’s lecture series provides a thoughtful and novel analysis which is useful for at least two reasons. Firstly, it constructs a new lens through which we might be able to apprehend not only the current situation but also our place within it. Secondly, this provides the catalyst through which a new approach to activism and resistance could be delineated. In this sense, Feher’s analysis is useful not only for academics involved in new work regarding neoliberalism, but also committed activists and others who are interested in seeking alternatives to the neoliberal present we find ourselves in.

[i] Foucault, M., The Birth of Biopolitics: Lectures at the College de France 1978-1979 (New York: Palgrave Macmillan, 2010)

[ii] Ibid., p. 145

[iii] Dardot, P., & Laval, C. The New Way of the World: On Neoliberal Society, (London and New York: Verso, 2013).

[iv] Mirowski, P. Never let a Serious Crisis Go to Waste: How Neoliberalism Survived the Financial Meltdown (London and New York: Verso, 2013)

[v] I will be summarising some of the arguments made in Feher’s lectures, which you can see here:

http://www.gold.ac.uk/visual-cultures/guest-lectures/

[vii] See: https://vimeo.com/123325158

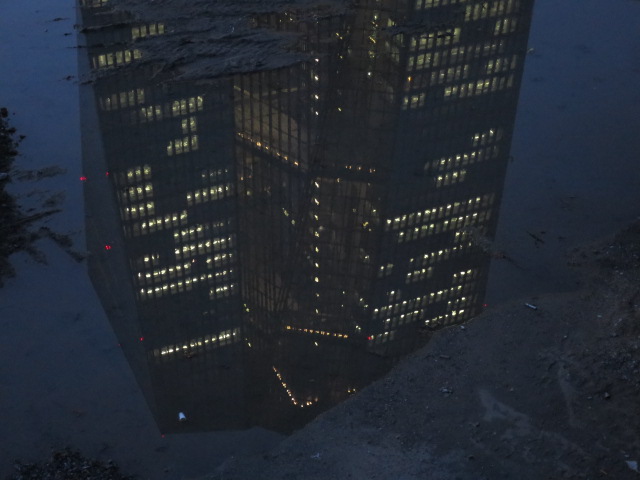

taken from here

Foto: Bernhard Weber