Even those persons paralyzed by anxiety over their lack of knowledge of financial economics will intuitively grasp that uncertainty pervades an attempt to ascertain what will have been the value of an asset in the future, relative to its subsequent past value now in the present. Can this even be done? BSM says it can.

Initially BSM announced itself as a risk-neutral, nonarbitrage model for pricing options. We will later expand on the importance that BSM isn’t quite used like this today. But let us presently observe that BSM is indeed a nonarbitrage model, albeit one whose condition of possibility and goal is arbitrage. However, BSM asserts that when deploying its partial differential equation to determine the value of an option, i.e. in order to know in the future what will have been the value of an option today, an operator must know four things:

(i) the option’s time to maturity (T)

(ii) the riskless interest rate (r)

(iii) the referent price (S0)

(iv) the volatility of referent price (σ)

The first three parameters are easily found. They’re either quoted in the market, or in the case of the first parameter, (T) time to maturity, i.e. the option’s expiration date, is written into the terms of the contract itself. However, the fourth parameter, volatility, is a bit trickier. BSM presumes a normal distribution, or ‘constant’ volatility –which amounts to erecting a thin epistemological wall to artificially insulate its model from jumps, irregularities, or volatile volatility, hoping those hideous animals on the other side won’t breach its perimeter, and stroll right in. Is to know volatility ontologically impossible? What even is volatility?

These queries have no quick redress, but are crucial for grasping the model of economy of deterministic chaos that is dromocracy proposed by D&G, and which in 2014 we have been and will be continuing to elaborate. Let us then move through its logic, or at least of it what we presently know.

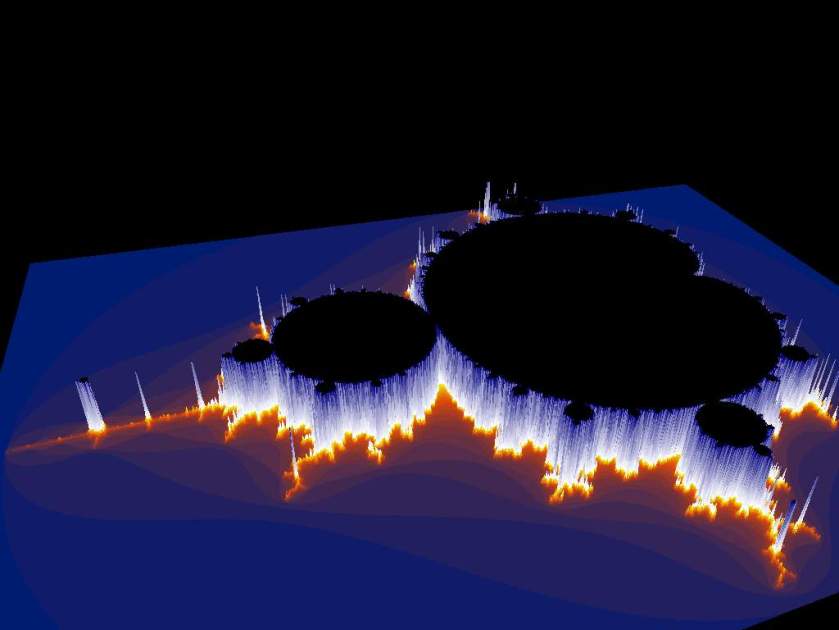

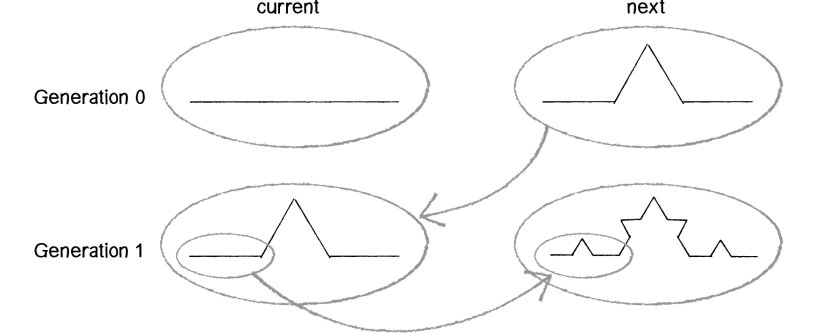

If markets make a random walk, so too are plots of trajectories of the price movements of its assets, whose economic properties orbit along their markets’ surfaces. This means volatility is stochastic, unsteady, intractably irregular, a dark beast –and therefore this fourth parameter that an operator ‘must’ know to use BSM exhibits some determinism, yes, but a determinism wholly infused with chaos, or even is chaos.[1] Time spent studying the behavior of any class of financial asset causes quick realization that data on ‘past’ or ‘historical volatility’ (also called ‘actual volatility’)[2] is available but not dispositive for knowing future price movements. So any attempts by a BSM operator to divine ‘future volatility’ amounts to an attempt to solve a differential equation by way of a nondifferentiable function (*it can’t be done). Operators know this, and for this reason elect to retain BSM, but invert its equation to iterate ‘implied volatility’. Doing so, an operator must still know four things:

(i) the option’s time to maturity (T)

(ii) the riskless interest rate (r)

(iii) the referent price (S0)

(iv) the volatility of referent price (σ) (iv) the market price of the option

…but all four of which are now dictated or conveyed by the market, are messages transmitted in and by the market: the new fourth parameter is combined with the previous three parameters, and now used to derive the as-yet-unactualized volatility implied by the current market price of the option. The BSM operator, then, no longer plugs in the parameter of a normally-distributed volatility, which is to say a ‘constant’ volatility presumed to be actual, actualized, or ever actualizable, in order to derive the theoretical value of an option, but now plugs in the market price of the option to derive the theoretical value of volatility –i.e. the virtual value of volatility that an actual option price implies. Does this not render implied volatility a partial relic of the virtual that’s yet now paradoxically actual as well? In a future post we will take up this technological issue by opening up, to briefly peer inside, the peculiar material profundities interpellating implied volatility, which we believe is an intensive economic property: an odd, rare empirical instance of a differentiated aspect of the virtual that’s been refracted through itself and now dumped out into actuality; giving rise to ‘actual volatility’ at the same time such actualization of the latter covers or cancels it out.[3] Moreover, some attention directed to the robust Deleuzian-dynamical systems theoretic sense of the concept ‘intensive’ organically breeds our conviction that implied volatility is readily deployable as a fungible pricing mechanism, far more commensurate with the economic institutions and endemic behaviors of the denizens of a dromocracy, than that base and placid, one-dimensional, extensive medium of exchange we call ‘money’.

Presently, our brief tutorial on options will presume little background on our reader’s part.[4]

Financial derivatives comprise a class of financial assets. Options comprise a class of financial derivatives. In dromocracy, the exchange of options, especially exotic options (or simply ‘exotics’) comprise its principal class of exchange. Contingent local communities of becoming are ‘clusters’, rendering ‘clusters of exotic options’ (CEOs) one of its two economic institutions (the second being a universal synthetic CDO, to be outlined a bit later). In dromocracy, exotics among clusters are traded en masse.

The standard, if only sometimes correct definition of a financial derivative is an asset whose value derives from some other asset, often called a referent or underlier.[5] We’re supposed to tell you this; but it need not overly concern us, and at any rate, like the principles of Euclidean geometry, is not so much always wrong as it is only sometimes true. Our real concern is that an option is a nonlinear financial derivative producing a contingent claim; and that holding an option gives one the right to do something by a certain date, it gives the option holder choice, or optionality. Taleb tells us that ‘optionality is a broad term used by traders to describe a nonlinearity in the payoff of an instrument’[6], which will be particularly compelling to a reader who is now beginning to cognitively synthesize that rhizomes-nonlinearity-chaos-financial derivatives are the constitutive components of dromocracy, and that such novel model of economy is available to us if we so choose.

There are two kinds of options. There are ‘call options’, the holding of which gives one the right to acquire something at a certain price (called the ‘strike price’), on or by a future date (called ‘maturity’ or ‘expiration’). And there are ‘put options’, the holding of which gives one the right to part with something at a strike price on or by a future date. The terms ‘European’ and ‘American’ have nothing to do with where the options are written, read, or otherwise exchanged. Rather, European options can only be exercised on the day of their expiration, while American options can be exercised any time between their inception and expiration.

‘Operators’ are those persons exchanging options. Operators trade optionality. There are two types of operators: ‘writers’ and ‘readers’. To write optionality is to compose and sell an option for a fee to a reader, who now holds the right to choose to acquire some pre-agreed-to asset, whether an object or service, at a predetermined price, if mutually-pre-agreed-to conditions are met either at maturity or during the life of the option. To read optionality is to buy an option for a fee from a writer, who now accepts liability to deliver some pre-agreed-to asset, whether an object or service, at a predetermined price to the reader, if mutually pre-agreed-to conditions are met either at maturity or during the life of the option. Writers, then, issue optionality for a price, and accept liability if conditions written into the option are met. Readers accept optionality with a price, and exercise their choice if conditions written into the option are met.

What we have just said equally applies to exotics or vanillas, which are the two classes of options. Vanillas are standardized, and conventionally-structured. Exotics are bespoke, and have non-conventional structures. However, we will principally concern ourselves with exotics. It worth noting here, to begin, that pricing exotics can quickly become quite complicated in ways not conquerable by however-sophisticated modeling techniques, therefore generating available arbitrage opportunities for its operators. Importantly, this is due to exotics’ high-degree of nonlinearity: vanillas, yes, are already nonlinear, since all options are nonlinear assets; albeit exotics exhibit a higher degree of nonlinearity, as we will show. Exotics are to be the principal class of options exchanged in a dromocracy.[7]

BSM’s original assertion is that in theory it’s possible to construct a riskless portfolio, comprised of a position in options and some referent, such as stocks (though it could be any generic asset). We henceforth call this portfolio a ‘package’.[8]

Scholes says, ‘Black’s and my discovery was how to price options and to provide a way to manage risk.’[9] Derman and Taleb remind us this doesn’t mean that options are rendered riskless assets, or that an option’s actual price movements are in any way predictable, periodic, or nonstochastic.[10] Rather, the success of BSM’s pricing model pivots on hedging. And not just any hedging, but delta hedging –whose wager is that if an operator can get the delta of their package ‘right’, and then hedge accordingly and continuously, any price movements in an option position will always be offset by price movements in the referent position, and vice versa: and that these price movements offset one another means that the delta of the package at any given point in time, while not strictly zero, is nonetheless always striving towards it, tending towards it, asymptotically ever attempting to move yet closer to zero. The delta of the package is perpetually a becoming-zero.

[1] We’ll see that the issue is more involved than this. The initial model of price behavior used by BSM assumed that price changes are stochastic and normally distributed. To simply assert that a process is ‘stochastic’, or random, only further begs the question of the order and degree of its randomness –there are, after all qualitatively different classes of stochastization, so that any identification of a process as random must clarify to what class of randomness the process belongs (e.g. a Markov, Wiener, Itô, or Deleuzian process)? The answer given by BSM is that volatility exhibits a randomness that is normally-distributed, which makes it a Weiner process, but which turns out to be problematic. Today the standard financial economic definition of its class of stochastization is an Itô process, which we will show is also problematic.

[2] Our reader will be reminded that the three registers of reality in Deleuze’s ontology are actual-potential-virtual. ‘The actual’ is simply that which ‘is’ differentiated (what is sometimes mistakenly labeled ‘reality’). ‘The potential’ also is that which ‘is’, albeit only ‘is’ as a possibility (Deleuze identifies the potential as that which is subject to a probability distribution, but whose possible outcomes are therefore predetermined by the interlocutions of the actual and virtual). ‘The virtual’ is neither actual nor potential, and yet it exists ‘in reality’ nonetheless. A good deal of Deleuze’s project is to make technical recourse to mathematics and sciences to illustrate that while neither actual nor potential, the virtual comprises another register of reality altogether –a register structuring the space of what is possible to become actual.

[3] It is far from evident this notion is wholly comprehensible in Deleuze’s ontology. Its presentation, however, is far from a foreign element in his house. On the one hand, Deleuze toes the standard dynamical systems theoretic line that intensive properties often or always are canceled in those systems in which their spatiotemporal dynamisms generate the actualization of the extensive properties, whose very generation cancels them out. For example (‘There is an illusion tied to intensive quantities. This illusion, however, is not intensity itself, but rather the movement by which difference in intensity is cancelled. Nor is it apparently canceled. It is really canceled, but outside itself, in extensity and underneath quality.’) Difference & Repetition pg. 240; and (‘Intensity creates the extensities and qualities in which it is explicated….It is nevertheless true that intensity is explicated only in being cancelled in this differentiated system.’) Ibid pg. 255 Also see Ibid pg. 228. However, on the other hand, Deleuze’s (and D&G’s) special interest in complex, high-order, nonlinear chaotic systems (i.e. ‘systems of difference’) is their explication of relics of the virtual, e.g. intensive properties, whose logic can then be traced back up through the actual, and tinkered with. After all, why map, e.g. in phase space –if not to then tinker with matter’s evolutionary capacities? For example (‘it is in [systems of] difference that…phenomena flash their meaning like signs. The intense world of differences…is precisely the object of a superior empiricism. This empiricism teaches us strange “reason” [read: strange attractors], that of the multiple, chaos, and difference.’)

[4]The best book on options for the nonspecialist is John C. Hull Options, Futures, and Other Derivatives, Prentice-Hall 2009. For this reason, on our reader’s behalf we draw on Hull throughout Part IV.

[5] For example (‘A derivative can be defined as a financial instrument whose value depends on (or derives from) the values of other, more basic, underlying variables. Very often the variables underlying derivatives are the prices of traded assets. A stock option, for example, is a derivative whose value is dependent on the price of a stock. However, derivatives can be dependent on almost any variable, form the price of hogs to the amount of snow falling as a certain ski resort.’) Hull pg. 1; and (‘A derivative is a security whose price ultimately depends on that of another asset (called underlying). There are different categories of derivatives, ranging from something as simple as a future to something as complex as an exotic option, with all shades in between.’)Taleb pg. 9

[6] Ibid pg. 20

[7] In dromocracy there are two types of markets, ontologically-speaking, whose materiality is bound as one: there are commoditized products, which have standardized agreements in place to eliminate non-template inconveniences, and range from simple ‘spot-priced’ classic objects (e.g. things to eat and wear), to low-order forms of exotics (e.g. single barrier knock-outs); there are also nonstandard products, which are wholly exotic, and whose payoffs are specific to the instrument –these comprise the majority of contracts for work relations for the denizens of dromocracy. With such exotics, everyone is constantly tracking their Greeks. We thus agree with Taleb’s itemization of the basic difference between commoditized and nonstandard products, when he observes that ‘the real difference between [the two] is that one type is tailor made, with [higher risk and volatility, and] smaller traffic, while the other has features of a discount store with standard sizes and prices, but a higher volume.’ Taleb pg. 51

[8] Hull (2009) defines a conventional package (‘A package is a portfolio consisting of standard European calls, standard European puts, forward contracts, cash, and the underlying asset itself.’) pg. 555. We will ultimately wish to tailor this general concept to include an individual’s total portfolio of assets –generic and synthetic, comprised of exotic options and CLNs, as well as the synthetic assets whose total notional value comprises an individual’s universal synthetic portfolio, which is why we have neologized the term herein.

[9] Myron Scholes, “Derivatives in a Dynamic Environment”, The American Economic Review, Vol. 88, No.3, June 1988 pg. 351

[10] Emanuel Derman and Nassim Nicholas Taleb, “The Illusions of Dynamic Replication”, first draft Apr. 1995

taken from here